As we step into 2024, many changes are set to shape the landscape of employment in Germany. One of the most significant shifts on the horizon is the anticipated adjustments to Mindestlohn, or minimum wage. But what does this mean for employees and employers alike? Understanding these updates is crucial, as they will impact not just paychecks but also job opportunities and workplace dynamics across various sectors. Join us as we delve into what you need to know about Mindestlohn 2024 and how it could affect your financial future.

What is the Minimum Wage?

Minimum wage refers to the lowest legal salary that employers can pay their employees. This law is designed to protect workers from exploitation and ensure they receive a fair income for their labor.

In Germany, the concept of minimum wage gained traction as part of broader social policies aimed at reducing poverty. It sets a baseline for wages across various sectors, making it crucial for both employees and employers.

The amount varies by country and can change over time based on economic conditions. In essence, it acts as a safety net for workers, ensuring that even those in low-paying jobs earn enough to meet basic living expenses.

Understanding this fundamental aspect of employment law is essential not just for workers but also for business owners who need to comply with regulations while managing operational costs effectively.

History of Minimum Wage in Germany

The concept of minimum wage in Germany has evolved significantly over the years. Before 2015, wage levels were largely determined by collective agreements between unions and employers.

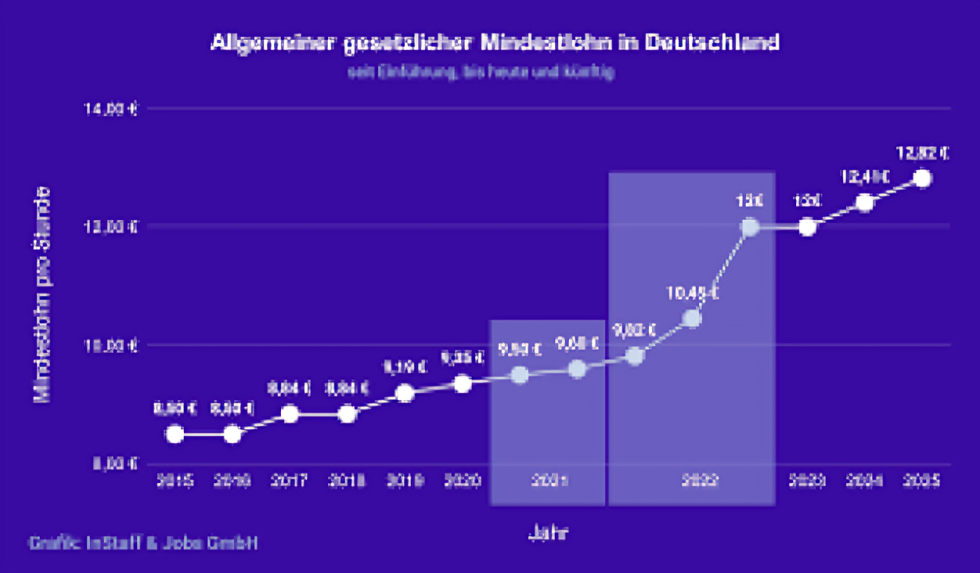

In July 2015, Germany introduced its first nationwide minimum wage, set at €8.50 per hour. This landmark decision aimed to improve living standards for low-wage workers while ensuring a fairer labor market.

Since then, adjustments have been made to keep pace with inflation and economic conditions. By January 2022, the minimum wage rose to €9.60 as part of ongoing reforms.

These changes reflect societal shifts towards valuing employee rights and maintaining competitiveness within Europe’s job market. The historical journey highlights an increasing recognition of the need for protective measures in labor laws across various sectors.

Changes and Updates in the 2024 Law

The Mindestlohn 2024 introduces significant changes aimed at improving workers’ rights and economic stability.

From January 1, 2024, the minimum wage will increase to €12 per hour. This adjustment reflects a growing recognition of living costs and inflation pressures faced by employees.

Employers must now adapt their payroll systems to comply with this new rate. Failure to do so could result in penalties or legal repercussions.

Additionally, there’s an emphasis on transparency regarding wage structures within companies. Employers are encouraged to communicate clearly about pay scales, ensuring employees understand how wages are determined.

Another noteworthy change is the expanded coverage for sectors previously excluded from minimum wage regulations. This shift aims to protect more workers across various industries, promoting equity in compensation practices throughout Germany.

Impact on Employees and Employers

The introduction of Mindestlohn 2024 brings significant changes for both employees and employers. For workers, the increase in minimum wage can enhance their quality of life. Higher earnings mean better access to necessities, healthcare, and savings.

However, this change may also create challenges for businesses. Employers might face increased labor costs. Small companies could feel the pinch more than larger corporations with deeper pockets.

As a result, some employers may need to reassess their budgeting strategies. They might explore automation or streamline operations to manage expenses effectively.

Employees could experience greater job security as well since higher wages often lead to improved morale and productivity. A motivated workforce can drive business success through enhanced performance.

Yet these adjustments will require thoughtful planning from all parties involved. Negotiations between management and staff may become crucial as everyone adapts to the new landscape shaped by Mindestlohn 2024.

Strategies for Adjusting to Mindestlohn 2024

Adjusting to Mindestlohn 2024 requires proactive planning. Employers should begin by reviewing their current payroll structures. Identify roles that will be directly affected and calculate the potential financial impact.

Consider adjusting work hours or project scopes to manage costs effectively. This could mean redistributing tasks among employees or offering flexible schedules to maintain productivity without sacrificing quality.

Invest in training programs for staff, enhancing skills can lead to increased efficiency. When employees feel valued through development opportunities, morale often improves alongside performance.

Communicate openly with your team about these changes. Transparency fosters trust and understanding, making transitions smoother for everyone involved.

Explore automation options where feasible. Streamlining processes can help mitigate budgetary constraints while maintaining service levels during this adjustment period.

Conclusion

Understanding Mindestlohn 2024 is essential for both employees and employers navigating the evolving landscape of labor laws in Germany. The minimum wage plays a critical role in ensuring fair compensation, influencing living standards, and shaping economic conditions.

With the recent updates set to take effect, it’s crucial to stay informed about how these changes may impact your work situation or business operations. Employees should be aware of their rights and benefits under this new law while employers must strategize effectively to adapt without compromising their operational integrity.

As we move forward into 2024, being proactive will help everyone navigate these changes with ease. Whether you are an employee seeking clarity on your earnings or an employer adjusting payroll structures, keeping abreast of developments related to Mindestlohn can pave the way for smoother transitions ahead.