The banking industry is undergoing a seismic shift. With rapid advancements in technology, the landscape of financial services is transforming before our eyes. Traditional banks are no longer the sole players; new challengers and innovative solutions are emerging daily. In this dynamic environment, UBS has been making headlines with its recent news, offering insights into where the future of banking may be headed. This blog post will explore these developments and what they mean for consumers and investors alike. Buckle up as we dive into the evolving world of finance shaped by UBS News!

UBS’s recent financial reports and projections

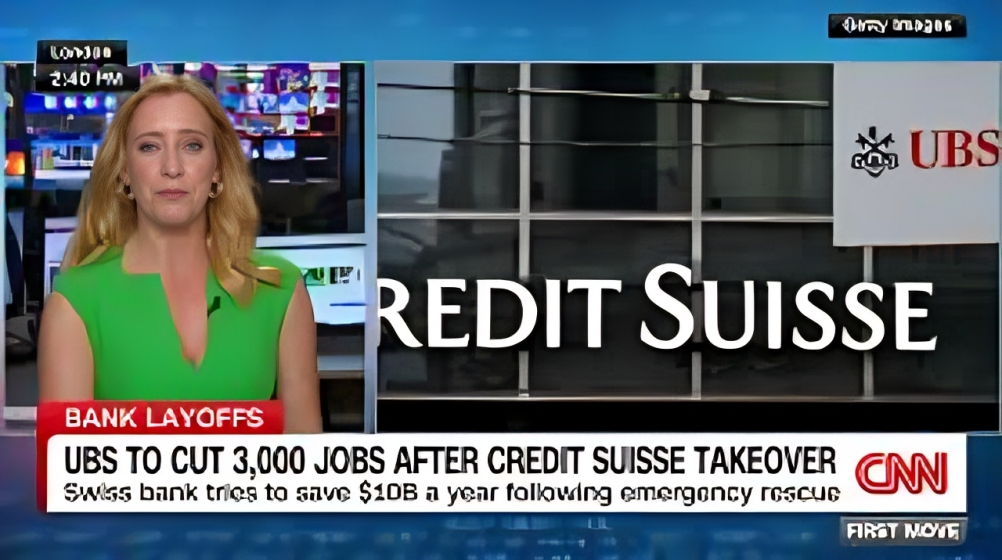

UBS’s recent financial reports reveal a dynamic outlook for the bank. Analysts noted an impressive increase in net profit, signaling strong operational resilience despite global economic fluctuations.

The projections showcase strategic growth areas, particularly in wealth management and investment banking. UBS is positioning itself to capitalize on emerging market opportunities while navigating potential challenges ahead.

Investors are keenly watching the developments as UBS outlines targeted initiatives aimed at enhancing efficiency and profitability. The emphasis on innovative solutions indicates a commitment to adapting in a rapidly evolving landscape.

Moreover, these reports highlight UBS news proactive approach to risk management. By identifying key trends early, the bank aims to maintain its competitive edge and secure long-term growth trajectories amidst uncertainties.

Digital transformation in the banking industry

Digital transformation is reshaping the banking landscape at an unprecedented pace. Traditional banks are no longer just brick-and-mortar establishments; they’re evolving into tech-driven entities.

Banks are investing heavily in technology to enhance their services. Mobile applications, online platforms, and AI chatbots are becoming integral. These innovations streamline operations and improve customer interactions.

Customers now expect seamless experiences across all channels. The demand for quick transactions and personalized services has never been higher. A user-friendly interface can make or break a customer’s loyalty.

Moreover, regulatory compliance is being transformed through digital solutions. Automated systems help banks navigate complex regulations efficiently while minimizing risks.

As we move forward, embracing these technological advancements will be essential for survival in this competitive environment. Banks must adapt to thrive amidst rapid change.

Impact of technology on customer experience

Technology is reshaping the customer experience in banking. With mobile apps and online platforms, customers now access their accounts anytime, anywhere. This convenience fosters a sense of control and engagement.

Chatbots and AI-driven services provide instant support. Customers appreciate quick responses to inquiries without waiting on hold for hours. Personalization has also become more prominent; algorithms analyze user behavior to offer tailored recommendations.

Security measures have evolved as well. Biometric authentication methods enhance safety while simplifying transactions. Customers feel more secure knowing their information is protected through advanced technology.

Moreover, data analytics allows banks to anticipate customer needs better than ever before. By understanding spending habits, banks can proactively offer products that match individual lifestyles.

As digital tools continue to advance, customer expectations will rise accordingly. The industry must keep pace with these changes or risk falling behind competitors who prioritize tech-driven experiences.

The rise of fintech companies and competition for traditional banks

Fintech companies are reshaping the financial landscape, challenging traditional banks like never before. With their agile models and innovative solutions, these startups attract a growing customer base.

Customers now demand convenience and speed. Fintech firms deliver this through mobile banking apps, peer-to-peer lending platforms, and cryptocurrency exchanges. They cater to tech-savvy individuals who prefer managing finances with a tap on their smartphones.

Traditional banks face pressure to adapt quickly or risk losing market share. Many are investing heavily in digital tools to enhance user experience. However, adapting corporate culture can be slow.

The competition is fierce as fintechs continuously push boundaries with lower fees and enhanced services. Traditional institutions must rethink strategies or collaborate with emerging players to stay relevant in this evolving environment where agility reigns supreme.

UBS’s efforts towards sustainability and ESG investing

UBS is making significant strides in sustainability and ESG investing. The bank recognizes the pressing need to address climate change and social issues.

Their commitment is evident through various initiatives aimed at reducing carbon footprints across their operations. UBS news actively integrates environmental, social, and governance criteria into its investment strategies.

The firm has launched several funds focused on sustainable investments. These options allow clients to align their financial goals with personal values. This proactive approach attracts environmentally conscious investors.

Furthermore, UBS collaborates with industry leaders to develop standards for responsible investing. Such partnerships enhance transparency and foster trust in the financial system.

By prioritizing sustainability, UBS not only meets regulatory expectations but also positions itself as a leader in shaping a greener future for finance. Their efforts signal a broader trend within the banking sector towards more ethical practices that resonate with today’s socially aware consumers.

Potential challenges and opportunities for the future of banking

The future of banking is filled with both hurdles and possibilities. As technology continues to evolve, traditional banks must adapt or risk becoming obsolete. Regulatory pressures are increasing, demanding greater transparency and security. These challenges could strain resources for many institutions.

On the flip side, innovation presents a wealth of opportunities. Embracing advancements like artificial intelligence can streamline operations and enhance decision-making processes. Banks that invest in technology will likely find themselves at a competitive advantage.

Customer expectations are shifting as well. Consumers now seek personalized experiences tailored to their unique needs. This creates an opportunity for banks to leverage data analytics to improve service offerings.

Sustainability initiatives also play a crucial role moving forward. Institutions prioritizing environmental, social, and governance (ESG) investing may resonate more with today’s socially-conscious consumers. Balancing these factors could define the next era in banking success.

Conclusion

The banking industry is undergoing a significant transformation, driven by various factors highlighted in recent UBS news. As traditional banks adapt to shifting consumer expectations and technological advancements, they face both challenges and opportunities.

UBS’s financial reports signal a proactive approach to these changes. Their emphasis on digital transformation showcases a commitment to enhancing customer experience through innovation. This aligns with the broader trend of fintech companies stepping into the arena, intensifying competition for established players.

Moreover, UBS’s dedication to sustainability and ESG investing reflects an evolving mindset within finance. The focus on ethical practices resonates with modern investors who prioritize social responsibility alongside profitability.

As we look ahead, the landscape will continue to evolve rapidly. Banks must stay agile and responsive to maintain relevance in this dynamic environment shaped by technology and changing consumer demands. By embracing these shifts thoughtfully, institutions like UBS news can lead the way into a promising future for banking while addressing emerging challenges head-on.