In today’s ever-evolving job market, understanding various income types can be crucial for financial stability. One term that’s been gaining traction is “Erwerbsersatzeinkommen.” While it may sound complex, this concept plays a vital role in the lives of many individuals facing unexpected changes in their employment status. Whether you’re navigating personal challenges or simply curious about alternative income sources, unraveling the differences between Erwerbsersatzeinkommen and traditional income could offer valuable insights into your financial options. Let’s dive deeper into what makes Erwerbsersatzeinkommen unique and how it might benefit you or someone you know.

What is Erwerbsersatzeinkommen?

Erwerbsersatzeinkommen is a term rooted in the German social security system. It refers to income replacement benefits designed for individuals who can’t work due to health issues or specific life circumstances.

This financial support aims to bridge the gap left by traditional employment income. It’s particularly beneficial for those facing temporary setbacks, such as illness, disability, or parental leave.

The essence of Erwerbsersatzeinkommen lies in its ability to provide a safety net. By offering monetary assistance, it allows recipients to maintain their standard of living while focusing on recovery or personal responsibilities without the added stress of financial insecurity.

Understanding this concept can open doors for many seeking stability during uncertain times.

Comparison to Traditional Income

Erwerbsersatzeinkommen differs significantly from traditional income. While traditional income comes from a steady job, Erwerbsersatzeinkommen serves as a financial cushion during unforeseen circumstances like illness or unemployment.

Traditional income relies heavily on regular hours worked and the associated paychecks. It provides stability but can be limited by job availability. In contrast, Erwerbsersatzeinkommen is designed to replace lost earnings without requiring continuous work.

Another key difference lies in taxation. Traditional income often faces progressive tax rates based on your total earnings. On the other hand, Erwerbsersatzeinkommen may have different tax implications depending on individual circumstances.

Moreover, eligibility criteria vary widely between both types of income sources. Traditional employment typically requires specific qualifications and experience. Meanwhile, Erwerbsersatzeinkommen aims to support those facing hardship regardless of their previous employment status. This makes it a unique option for many individuals navigating life’s uncertainties.

Advantages and Disadvantages of Erwerbsersatzeinkommen

Erwerbsersatzeinkommen offers a safety net for individuals unable to work due to various circumstances. One significant advantage is the financial support it provides, helping people maintain their standard of living during tough times. This income can ease stress and uncertainty associated with job loss or health issues.

On the flip side, reliance on Erwerbsersatzeinkommen might deter some from seeking new employment opportunities. The comfort of guaranteed income could lead to complacency for certain individuals.

Another disadvantage is that eligibility requirements can be strict and complicated. Navigating these regulations may prove challenging, especially in urgent situations.

Moreover, while this form of income aids short-term needs, it doesn’t foster long-term career growth or development. Relying solely on Erwerbsersatzeinkommen may hinder personal progress and self-sufficiency over time.

Who Can Benefit from Erwerbsersatzeinkommen?

Erwerbsersatzeinkommen is designed for individuals who find themselves unable to work due to specific circumstances. This includes those recovering from long-term illness or injury. It provides a financial cushion during challenging times.

Freelancers and self-employed professionals can also benefit. When their income fluctuates, this support helps maintain stability while they seek new opportunities.

Parents on parental leave often turn to Erwerbsersatzeinkommen as well. Balancing family responsibilities with career aspirations can be tough, and this assistance makes the transition smoother.

Additionally, students juggling part-time jobs may find relief when faced with academic demands. This program allows them to focus on their studies without financial stress weighing heavily on their minds.

In essence, anyone experiencing significant life changes that impact earning capacity could explore the benefits of Erwerbsersatzeinkommen.

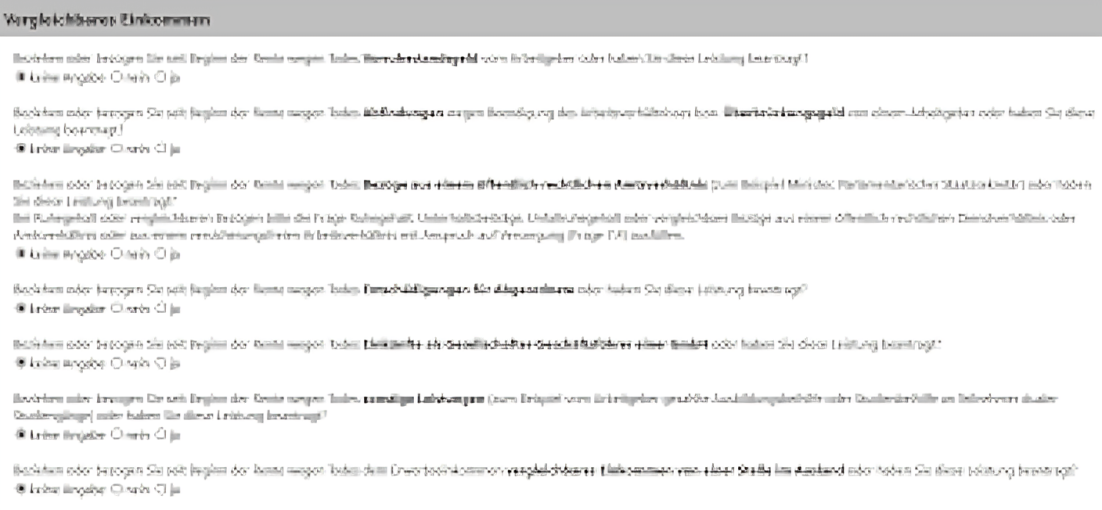

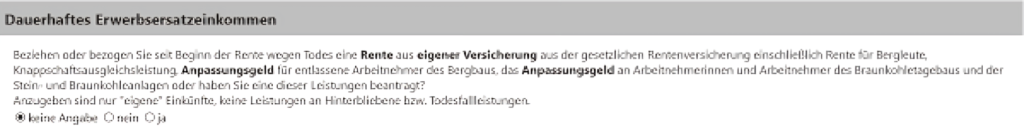

How to Apply for Erwerbsersatzeinkommen

Applying for Erwerbsersatzeinkommen is a straightforward process, but it does require attention to detail. Start by gathering essential documents. This includes proof of your previous income and any medical records indicating your inability to work.

Next, visit the official website or local office of the relevant authority that handles these applications in your area. They often provide downloadable forms that you can fill out conveniently at home.

After completing the application form, submit it along with all necessary documentation. Make sure everything is accurate and complete; missing information could delay processing time.

Once submitted, keep an eye on communication from the authorities. Follow up if you haven’t received updates within a reasonable timeframe. Being proactive can help ensure your application progresses smoothly while keeping stress levels low during this period.

Real Life Examples and Success Stories

Consider Anna, a freelance graphic designer. After an unexpected accident left her unable to work for several months, she turned to Erwerbsersatzeinkommen. This financial support not only covered her essential expenses but also allowed her to focus on recovery without the stress of immediate income loss.

Then there’s Markus, a small business owner who faced significant setbacks due to economic changes. He applied for Erwerbsersatzeinkommen during this challenging period. The assistance helped him maintain his operations while he strategized new ways to grow his business in a shifting market landscape.

These stories exemplify how Erwerbsersatzeinkommen can provide crucial support during difficult times, empowering individuals to rebuild and thrive despite unforeseen challenges. Each success story reflects resilience and resourcefulness in overcoming adversity with the right help at hand.

Conclusion

Understanding the differences between Erwerbsersatzeinkommen and traditional income can significantly impact your financial planning. Whether you are dealing with a sudden job loss or transitioning to new opportunities, knowing how these two forms of income function helps you make informed decisions.

Erwerbsersatzeinkommen provides essential support for those who find themselves unable to work due to various circumstances. It offers more than just financial assistance; it acts as a safety net during challenging times.

Through this article, we explored its advantages and disadvantages, helping you weigh your options when considering which form of income best suits your needs. By identifying who can benefit from Erwerbsersatzeinkommen, we’ve highlighted the importance of tailored solutions in today’s diverse workforce.

For anyone looking to apply for Erwerbsersatzeinkommen, understanding the process is crucial. Real-life examples emphasize that people have successfully navigated these waters before you.

Awareness and preparation remain key components in enhancing personal finance strategies. The world of income sources may be complex, but knowledge empowers individuals seeking stability through different avenues like Erwerbsersatzeinkommen.